Even though most students focus on the process of getting into college, they should also be thinking about how to pay for the actual experience. Whether you are studying abroad or living at home the extra costs of college other than tuition can add up without you even noticing. Waiting until you get that acceptance letter to figure out how pay for tuition, textbooks, a dorm or apartment, food and entertainment might be too late.

Paying for college can be a bigger challenge than gaining admission to a school, as tuition keeps rising. Most students and their families are not able to afford college without some sort of financial assistance. Federal and private scholarships and grants are excellent ways to help fund the costs of higher education, but theses are limited resources. Many students will end up relying on student loans along with trying to find out how to get grants for college to help with their expenses. While necessary, this also means that these students will graduate with a great deal of debt hanging over their heads. With compound interest, some matriculating students may still be paying off their loans while taking out new ones for their own kids! And who knows how long the debt could chase them after. After all, can a debt collector collect after 10 years? It’s a question that needs thinking on.

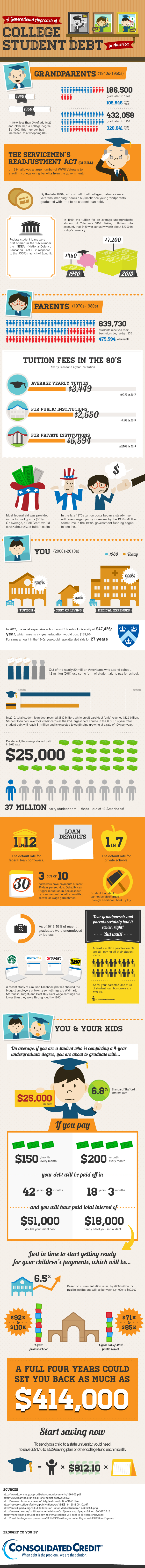

This infographic by Consolidated Credit covers the current state of student loans (and how it compares to the past). It shows you how much you end up paying if you only pay the minimum and how long it will take to pay off the loan, amongst other things. Find out more about how student loans affect millions of college students below.

For more see: consolidatedcredit.org