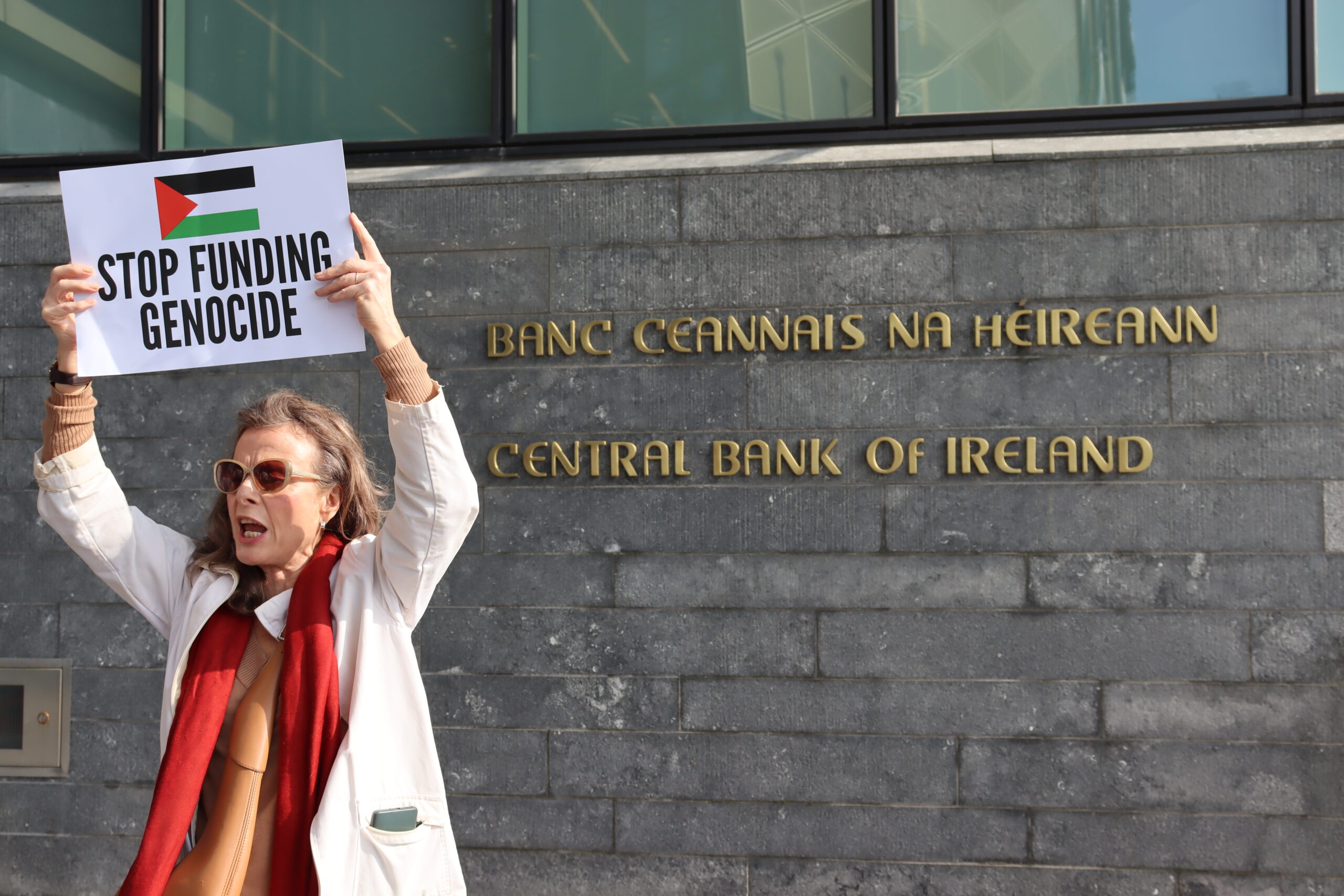

The Central Bank of Ireland (CBI), along with the Irish government, have been issued a formal legal warning following the CBI’s renewal of Israeli government bonds.

The letter, submitted by Gordon McArdle of GazaAid, calls for the immediate end to investment, trade, sales and purchases of Israeli assets due to concerns regarding Ireland’s financial complicity in Israel’s alleged genocide on Gaza.

A television interview broadcast by the CEO of Israel Bonds on October 16th 2023 confirmed that CBI-approved Israeli bonds were being used to finance Israel’s “war campaign” on Gaza, and the CBI’s renewal of these bonds in September 2024 has sparked protest concerning Ireland’s role in enabling the alleged genocide. The website promoting Israeli bonds sees Israeli President Isaac Herzog “rallying for unwavering support for the Jewish state” and emphasising “the crucial role of Israel Bonds during this time of conflict and war”.

This is underpinned by the International Court of Justice’s ruling of South Africa vs Israel, in which the claims that Israel is inflicting genocide on Gaza were found to be “plausible”. Following from this ruling, campaigners and activists have urged the Irish government to abstain from facilitating any actions which enable the ICJ-ruled genocide.

Previous to the legal warning, McArdle held an informal meeting with a representative from the CBI in hopes for them to “declare an end to the facilitation of genocide” through investing in these bonds. He stated that “nothing productive came from it” and that he found the approach of the CBI was very much to “continue investment and avoid discussions” surrounding the issue. He further explained that he believes the Irish government have shown complacency regarding CBI’s handling of Israeli bonds, as seen in the parliamentary questions asked during the financial instruments debate on the April 3rd, in which Minister for Finance Paschal Donohue stated “it is the position of the Central Bank, as set out by the Governor, that an advisory opinion of the ICJ or, indeed, the processes of the International Criminal Court do not constitute grounds for the Central Bank to refuse the prospectus of the Israeli bond programme”.

When asked for a comment regarding the Israeli bonds, the CBI stated that “by approving a bond prospectus, the Central Bank does not endorse the issuer or the securities”. This is not the first time the CBI has been asked to speak on the topic, as they held correspondence with the Oireachtas Committee on Finance, Public Expenditure and Reform following public scrutiny and concerns regarding the matter. The correspondence highlighted that the CBI can only refuse to purchase a bond if EU or national sanctions exist on Israeli financial institutions. As of May 2025, neither Ireland nor the EU have imposed sanctions on Israel.

McArdle outlines that the Central Bank’s links to such financial instruments “risks making the Irish state complicit in those crimes” and “it is time to take a clear stance before there is nothing left to stand for”. The letter highlights Ireland’s violation of multiple domestic and international human rights charters including the United Nations Genocide Convention, Customary International Law & State Responsibility, European Convention of Human Rights and Irish Constitutional Law, and rallies the CBI to disclose, cease and divest trading of Israeli assets. In addition to this, he calls upon them to provide a written response to the letter within fourteen days.

If the CBI fails to take “immediate remedial action”, McArdle asserts that further legal action will be taken. This will mainly be in the form of injunctive relief, which is a court order which prohibits an organisation from taking a certain action. Speaking with The University Times about the legal approach taken to the letter, McArdle stated it was drafted entirely through his own research; however, if put in a position where injunction must be sought, he stated he would seek judicial review in order to ensure the case is “airtight” when it reaches the Irish High Court.

29/05/25 Correction: A previous iteration of this article’s first line read: “The Central Bank of Ireland (CBI), along with the Irish government, have been issued a formal legal warning following the CBI’s purchase and renewal of Israeli government bonds”. This is incorrect as the CBI has not bought Israeli bonds and the line has been changed to reflect that.